Marriott’s loyalty program is called Marriott Bonvoy and is one of the largest loyalty programs in the world. With over 30 brands and 8,700 properties across 139 countries, it has something to offer almost everyone. But its not without its drawbacks.

As a lifetime Titanium member who has spent over one thousand nights at Marriott properties, I have learned a thing or two about the Marriott Bonvoy program.

Here is everything you need to know about the Marriott Bonvoy program. How to earn points, how to redeem points, how to get elite status, what hotels award you with the most points, etc… it’s all here.

The Marriott Rewards Program – Marriott “Bonvoy”

In 2016 Marriott bought Starwood Hotels & Resorts and created the world’s largest hotel company with more than 6,700 properties in 127 countries, spread across 30 hotel brands. The merger resulted in a mega hotel company with some of the most exclusive properties in the world and three loyalty program’s that would have to be integrated and rationalized.

Initially, the Marriott, Starwood and Ritz Carlton loyalty programs were kept separate. Then in August 2018, Marriott unified the benefits across the three programs and merged them onto a single technology platform and reservation system, but still kept the 3 legacy program names alive and separate.

Marriott’s goal was always to create a single new rewards program, but the magnitude of moving 120 million members to a new program and platform required the integration to happen in phases.

Finally, on January 16, 2019 Marriott announced the brand name of their new rewards program. “Bonvoy” is the new name of Marriott’s loyalty program that went into effect on February 13, 2019.

Marriott Bonvoy Properties and Brands

Marriott Rewards, Starwood Preferred Guest and Ritz Carlton Rewards no longer exist. They have officially been combined into one uber-rewards program called Marriott Bonvoy. The combination of these three programs puts Marriott way ahead of all other hotel loyalty programs with the widest range of hotel properties with which to use your hard-earned points.

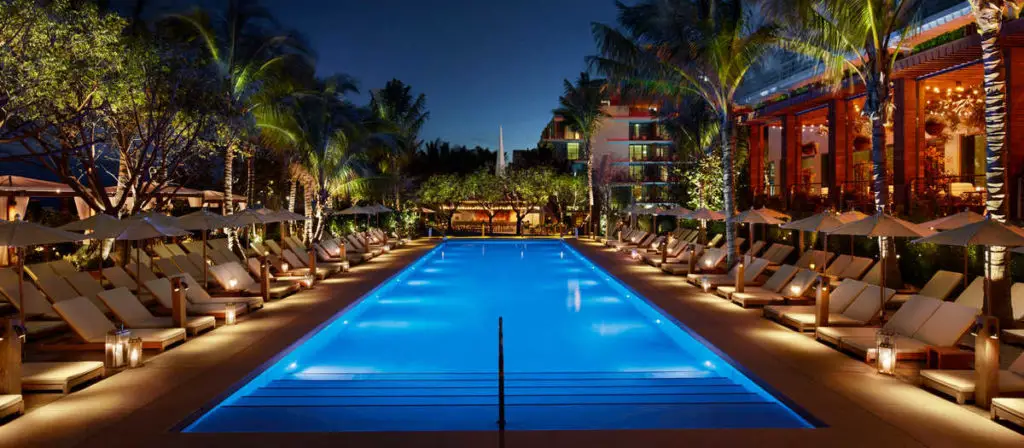

Marriott now has over 8,700 properties in 139 countries ranging from the ultra high-end St. Regis and Ritz Carlton brands to low-end, economy brands like Fairfield Inn and Four Points by Sheraton. Marriott has a hotel for every type of traveler.

However, trying to differentiate 30 brands within a large hotel portfolio is not easy. So to help to help put some perspective on the brands and their market focus, Marriott has segmented them into five broad categories of “Luxury”, “Premium”, “Select”, “Collections” and “Longer Stay” and then further sub-segmented each by “Classic” and “Distinctive” properties.

1. Luxury Properties

“Bespoke and superb amenities and services“

- Classic Luxury

- Distinctive Luxury

- The Luxury Collection

- The Ritz Carlton Reserve (Does not take part in the Marriott Bonvoy program)

- Bulgari Hotels (Does not take part in the Marriott Bonvoy program)

- W Hotels

- Edition

2. Premium Properties

“Sophisticated and thoughtful amenities and services“

- Classic Premium

- Distinctive Premium

3. Select Properties

“Smart and easy amenities and services“

- Classic Select

- Distinctive Select

4. Longer Stay Properties

“Amenities and services that mirror the comforts of home“

- Classic Longer Stays

- Distinctive Longer Stays

5. Collections

“Uniquely designed, each offering distinctive to luxurious experiences“

- Collections

Marriott Bonvoy Benefits & Elite Status

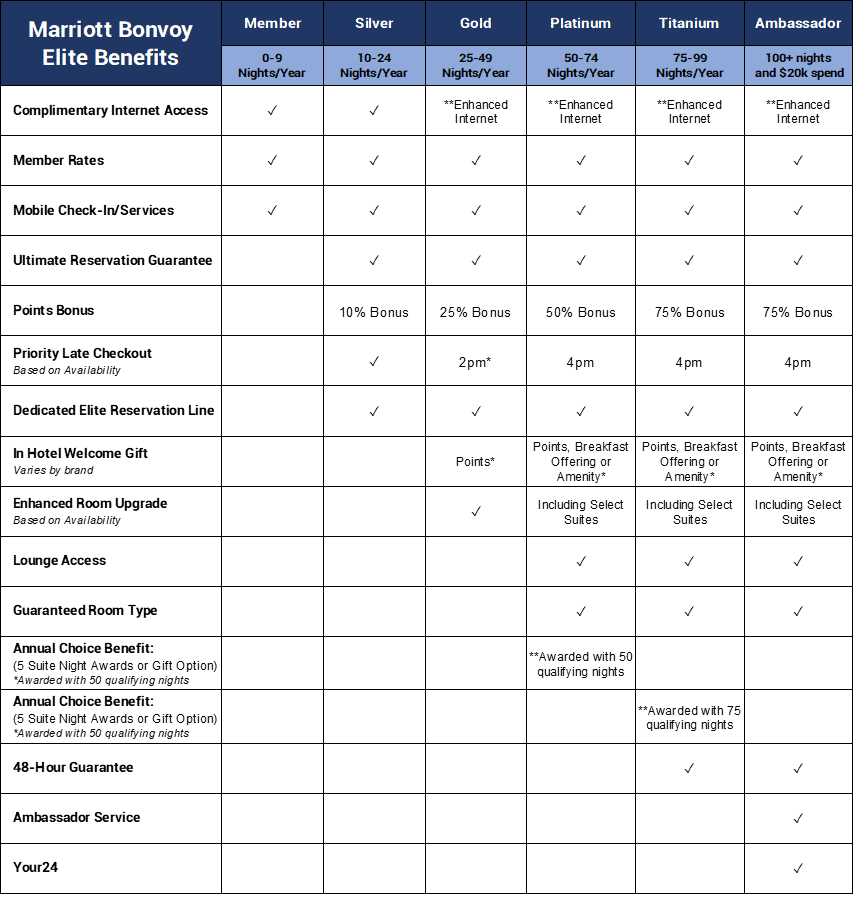

Marriott’s elite status offerings have grown with the new program. Marriott Bonvoy now has six levels of “Elite Status” plus three levels of “Lifetime Elite Status”.

The 6 Marriott Bonvoy elite levels are:

This chart summarizes the benefits of each Bonvoy elite status level.

Marriott also rewards long time, loyal customers with lifetime elite status to keep you from having to “chase” status every year. The Marriott Bonvoy Lifetime Elite Levels are as follows:

- Lifetime Silver Elite (250 lifetime nights + 5 years Elite status)

- Lifetime Gold Elite (400 lifetime nights + 7 years Gold Elite status or higher)

- Lifetime Platinum Elite (600 lifetime nights + 10 years Platinum Elite)

- Lifetime Titanium Elite (Grandfathered status – no longer available)

(The Lifetime Titanium Elite Status is a grandfathered status which was only achievable until December 31, 2018. Members received notice of this Lifetime achievement in January 2019. It was based on combined Marriott and SPG status prior to 12/31/2018. The requirement was 750 Qualifying Nights + 10 Years as Platinum Elite)

How to Earn Marriott Bonvoy points

The most obvious method for earning Marriott Bonvoy points is by staying at their properties. However, what isn’t so obvious is that not all properties treat the points earning process the same. For example, you will earn 10 points per dollar on all qualifying charges at most Marriott properties. However, Marriott’s “longer stay” properties are an exception that you need to be aware of.

- Element, Residence Inn, and TownePlace Suites earn 5 points per dollar on qualifying charges

- Marriott Executive Apartments and ExecuStay earn 2.5 points per dollar on qualifying charges

Pro Tip: If you are trying to earn Marriott points through hotel stays you should avoid Marriott’s longer stay properties as it will take at least twice as long to earn as many points as you would at other Marriott properties.

Important note about booking through Online Travel Agents (OTA’s): Rooms booked through third-party online retailers, such as Expedia.com, Orbitz.com, Travelocity.com, Hotels.com, Booking.com, Priceline.com, etc. are not eligible for points, miles or elite night credit. Wholesale packages and series tours also are not eligible for points, miles or elite night credit regardless of booking source.

The only way to guarantee you will earn Marriott points and elite night credits with your hotel stays is to book direct on Marriott’s website. But that doesn’t mean you have to pay rack rates.

Marriott is constantly offering special discounts and promotions to both lower your room rate and help you earn extra bonus points. You just need to know where to find the special rate codes and understand how to register for the promotions.

Earn Bonus Points with Bonvoy Promotions

Like all major hotel loyalty programs, Marriott frequently publishes promotions to allow members to earn more bonus points for their stays. You should always sign up for every Marriott promotion so you don’t miss out on an opportunity to earn bonus points. Even if you don’t have any travel plans in the near future you should still register.

Earn 1,500 bonus points on each stay plus an additional 3,000 bonus points for every three hotel brands you explore. Registration is required.

Registration takes less than one minute and doesn’t cost anything. If an unexpected trip comes up and you forgot to register you will miss out on the bonus opportunity and won’t be able to retroactively get the points. If you travel with any regularity, you should always register for all hotel promotions.

Earn Marriott Bonvoy points with credit cards

Credit cards are a great way to earn a bunch of extra points, especially with some of the big sign up bonuses they offer to new cardholders.

There are two ways to earn Marriott points from credit cards:

- Co-branded Marriott Bonvoy Credit Cards that earn Marriott points, and

- Credit Cards with flexible points that can be converted to Marriott points

Marriott Bonvoy Co-Branded Credit Cards

Marriott co-branded credit cards are available as both personal and business cards and allow you to earn Marriott points with every purchase you make. The points earned from your credit card spending will post to your Marriott Bonvoy account automatically each month.

Both American Express and Chase offer co-branded Marriott Bonvoy credit cards.

- Marriott Bonvoy Boundless Credit Card from Chase

- Marriott Bonvoy Premier Plus Credit Card from Chase

- Marriott Bonvoy Brilliant Card from American Express

- Marriott Bonvoy American Express Card

- Marriott Bonvoy Business Credit Card from American Express

Credit Cards with Marriott Bonvoy Transfer Options

You can also convert Chase Ultimate Rewards points into Marriott points at 1:1 ratio. You will have to manually make the transfer but it is really easy and the points post instantaneously.

The following cards earn Chase Ultimate Rewards Points:

- Chase Sapphire Preferred Credit Card

- Chase Sapphire Reserve Card

- Chase Freedom Unlimited Credit Card

- Chase Freedom Credit Card

- Chase Ink Plus Business Credit Card

Earn Marriott Bonvoy Points w/ Marriott Partners

There are a couple of partners that work with Marriott and allow you to earn Marriott points from purchases made through their Marriott partnership offer. They include:

- Hertz – Earn up to 2,000 Marriott Bonvoy points with each rental.

- Cruises Only – Earn 3 Bonvoy points for every dollar you spend when you book a cruise through the Marriott Cruises Only partnership link

Earn Marriott Bonvoy Points w/ Meetings & Events

Marriott Rewarding Events provide the ability to earn points or miles to members who book and hold qualifying group meetings and events at Marriott properties (except Residence Inn, Marriott Executive Apartments, and TownePlace Suites).

A member will earn two points for every U.S. dollar ($1.00) spent on qualifying event charges, up to a maximum of 60,000 base points per qualifying event.

Elite Members may earn more than the 60,000 base point maximum with extra bonus points:

- Silver Elite, 10% bonus, up to 66,000 points per qualifying event.

- Gold Elite, 25% bonus, up to 75,000 points per qualifying event.

- Platinum Elite, 50% bonus, up to 90,000 points per qualifying event.

- Titanium Elite, 75% bonus, up to 105,000 points per qualifying event.

You can also choose to earn airline miles instead of points for the meetings. In this case, members earn one frequent flier mile for every one U.S. dollar ($1.00) spent on qualifying event charges, up to a maximum of 20,000 miles per event, regardless of elite level.

Pro Tip: You also earn elite night credits for rewarding events, even if you only rent a small conference room for one day. Always make sure to instruct the hotel to put your conference room rental under the rewarding events program.

Earn Marriott Bonvoy Points with Emirates Airlines

Starwood had originally established a partnership with both Emirates and Delta to share elite status benefits and allow you to earn frequent flier miles with your hotel stays as well as hotel points with your flights.

The merger of SPG and Marriott eliminated the Delta “Crossover Rewards” program and partnership, but the Emirates partnership remains intact under the name “Your World Rewards“. The program is currently grandfathered and not open for new registration, but Marriott does indicate that registration could open again soon.

The Your World Rewards program lets you earn Emirate Skywards miles when you stay with Marriott.

- Emirates Skywards Silver, Gold, and Platinum members earn 1 mile per US dollar (on top of points) spent on all eligible stays at Marriott Bonvoy Hotels & Resorts

- Emirates Skywards Gold and Platinum members enjoy additional benefits at Marriott Bonvoy hotels, including 4 pm late checkout, access to the Elite check-in, and complimentary in-room Internet access.

How to Earn Frequent Flyer Miles with Marriott Bonvoy

If you prefer to earn frequent flyer miles over Marriott points, there is a way to do that as well through the Marriott Bonvoy program. Marriott has partnered with over 40 airlines to allow you to earn frequent flyer miles when you stay at Marriott properties.

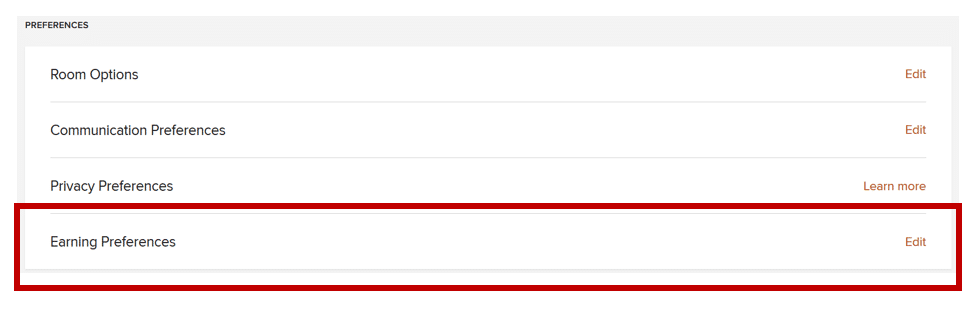

To change your earning preference from points to miles you will have to go to your Marriott Bonvoy “My Account” page. Go to the “profile” tab, and then scroll down to the “Earning Preferences” section, where a pop-up will ask you to choose either miles or points. If you select miles, you will then have to add your preferred airline and frequent flyer number.

How to Redeem Marriott Bonvoy Points

Now that we have covered all the ways you can earn points, let’s review how to use them.

Marriott has some great ways to redeem your Bonvoy points. As a general rule, the best redemption options are using your points for free hotel nights, transfers to frequent flyer miles, or unique experiences with Marriott Moments. Redeeming for gift cards, rental cars, cruises, and shopping are all options, but they provide a very low value for your points.

Redeem Bonvoy Points for Free Hotel Nights

Marriott Bonvoy points can be used to book free nights at Marriott properties worldwide, but the number of points required per night can vary. Marriott no longer has an award chart, so it’s become more difficult to determine the points needed for a specific hotel with their new dynamic pricing model.

Without an award chart, the new dynamic pricing model often requires significantly more points per stay, especially for their higher-end luxury properties.

5th Night Free

If you are staying at the hotel for 5 nights or longer, Marriott has a great 5th-night free option where you get a 5-night stay for the price of 4 reward nights.

Marriott PointSavers

Marriott also has PointSaver redemptions where you can save up to 33% when you book with PointSavers. These are fairly tough to find, but they do exist in off-season periods.

To see if a property is offering a PointSaver rate go to the booking page and enter your destination. In the dates field, scroll down and select flexible dates, then check the “use points” box and select the “Find Hotels” button. If a hotel is offering a PointSaver rate it will show up on the flexible dates availability screen.

Marriott Cash and Points

Cash + Points awards let you combine cash and points for discounted stays. Cash + Points also allow you to customize your stay by redeeming points for one night and paying cash for the next, which can be useful when rates vary throughout your stay.

How to Transfer Marriott Bonvoy Points to Frequent Flyer Miles

Marriott Bonvoy points can be transferred to airline miles with over 40 frequent flyer programs.

The transfer ratio is 3 points to 1 mile for most participating programs, plus there is a 5,000-mile bonus when you transfer 60,000 points to an airline program.

- Transfer points to more than 40 airlines, including United, Delta, Emirates, Lufthansa, China Eastern and more. The transfer ratio will be 3 points for one mile.

- Transfer as few as 3,000 points and up to 240,000 points per day — and any amount in between.

- As a bonus, Marriott will add 5,000 miles for every 60,000 points you transfer to airline miles, for a total of 25,000 miles in the airline program of your choice.

Due to their relationship with United, the best transfer option is with United Airlines where you get an additional 10% mileage bonus when you transfer your hotel points to United MileagePlus.

The relationship with United gets even better for Marriott Titanium members who get complimentary United MileagePlus Premier Silver status, which includes:

- Complimentary access to Economy Plus at check-in for you and a companion, when available

- Complimentary Premier upgrade confirmation as early as the day of departure, when available

- One complimentary checked bag (up to 70 pounds)

- Premier Access® priority airport services, where available

- 7 award miles for every dollar you spend on United flights

Use Marriott Bonvoy Points for Unique Experiences

One of the more unique ways to redeem your points is for “experiences” with Marriott Bonvoy Moments. This is a special program Marriott offers where you can “redeem or bid” on experiences and events. Your points can grant you VIP access to sporting events and concerts or even a private dinner with a celebrity chef.

Some packages appeal to a broad audience and are highly aspirational where the bidding goes through the roof, but you can also find experiences that don’t get as much attention and offer great value. Check the Marriott Moments page often to see what new experiences are being offered and how much interest there is in each one.

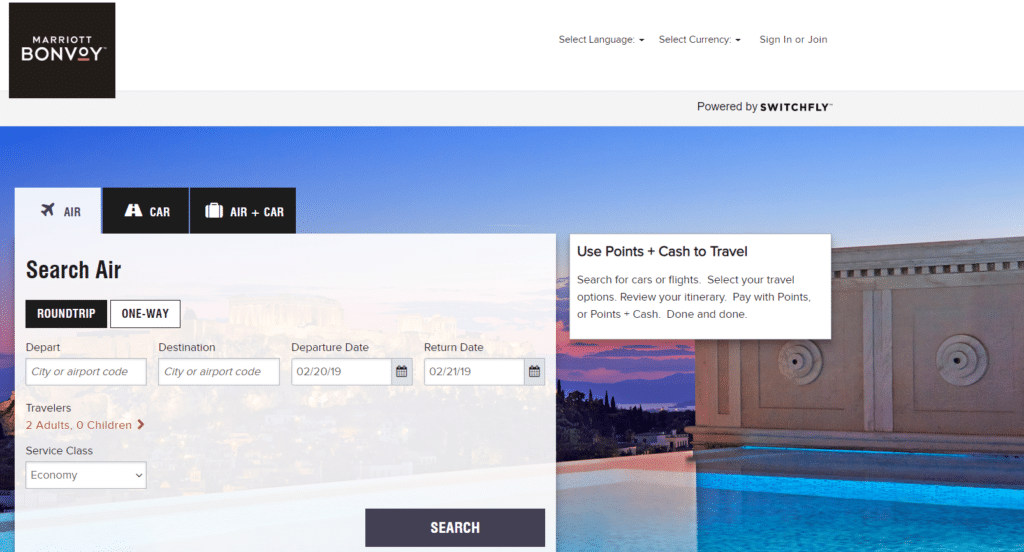

Use the Marriott Rewards Search Tool for Flights and Car Rentals

If you want to skip the step of transferring your Marriott points to an airline frequent flyer program you can use the Marriott Rewards Air + Car Search tool. With this option, you redeem Marriott Rewards Points directly for your airline ticket or rental car. Either pay with just points or with a combination of points and cash.

The benefit of this tool is that it allows you to skip the transfer step, expands your flight options to include more airlines, and eliminates blackout dates and other restrictions found with airline mile redemption programs.

However, this is not a good use of your points from a value standpoint. Based on some flight examples we ran, Marriott provides a value of about .4 cents per Marriott point when using this tool, which is not a good value for your points.

More Content for Marriott Bonvoy Fans:

If you like what you are reading now, here are some more great articles every Marriott Bonvoy member should check out!

- The Current Marriott Bonvoy Promotion

- Marriott Points Calculator

- The Best Marriott Corporate Codes for Business Travelers

- How to get Marriott Employee Discounts with the Explore Rate

- List of Marriott Breakaway Rates for Leisure Travel

- Marriott Travel Agent Rates

- Marriott Platinum and Titanium Benefits

Frequently Asked Questions

Marriott Bonvoy points do not expire, however your account will be closed if you have no activity in a 24-month period. Here is the statement from Marriott Bonvoy Terms and Conditions:

“A Membership Account may be closed at the Company’s discretion if no Points or Miles are accrued during a 24-month period. All Points in the Membership Account will be forfeited at that time.”

Tim is a business road warrior and avid leisure traveler who has flown over two million miles in the air and spent well over a thousand nights in hotels. He enjoys sharing tips, tricks, and hacks to help readers get the most out of their travel experience and learn how to “travel like a pro”!

Inspirato Pet Policy: Can You Bring Pets to Inspirato Homes?

Inspirato Pet Policy: Can You Bring Pets to Inspirato Homes?

Leave a Reply